Talking

Taxes

Talking Taxes will be closed from February 5-20 during the CRA update of the tax system. We will open again on February 21, 2024. Please note, we have not received confirmed funding for the program for this year. We will keep you updated.

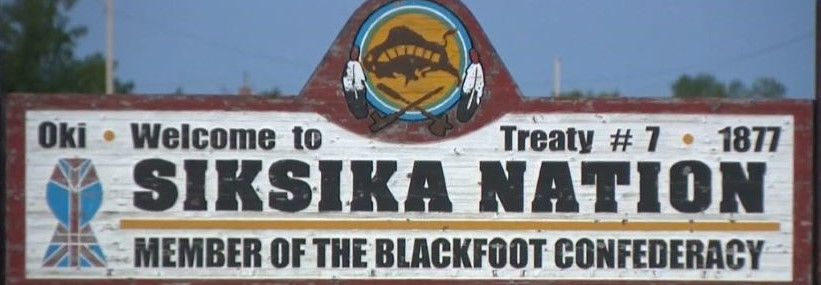

Rise Calgary is honored to provide a year round tax filing service on Siksika Nation through the Talking Taxes Program.

Our tax filing services are free for nation members living on a low to moderate income. We provide personal simple tax filing services only.

* We are unable to your taxes if you:

-

Are filing a Pre/Post Bankruptcy Return

-

Are filing a Deceased Return

-

Are Self-Employed

-

Have employment expenses

-

Have income sources that include Capital Gains, Farming Income, Commission Income, Investment Income over $1,000, Professional/Business Income, Rental Income

-

Other complex returns

Am I eligible to file my taxes with Rise Calgary?

To be eligible to file your taxes at a free low-income tax clinic, you must meet the requirements in the chart below.

Family size includes any adults and dependent children in the family unit.

If you do not meet the requirements below, please call us, there is a possibility you are still eligible.

Family Size

Total Family Income

1 person

2 persons

3 persons

4 persons

5 persons

More than 5 persons

$35,000 per year

$45,000 per year

$47,500 per year

$50,000 per year

$52,500 per year

$52,500 plus $2,500

for each additional person

How long will take to file my taxes?

Once you have completed your registration documents we will give you an idea of when to expect your taxes to be completed.

During regular tax filing season, it could take up to 4 weeks or more depending on the request and demand for our tax services.